Welcome to Pioneer Housing Finance Academy

The Finance (No.2) Act, 2019, has amended the National Housing Bank Act, 1987 conferring certain powers for regulation of Housing Finance Companies (HFCs) with Reserve Bank of India(RBI). The provisions of the said Act came into force w.e.f. August 09, 2019. Consequently, RBI vide a Press Release dated August 13, 2019, informed that the HFCs will henceforth be treated as one of the categories of Non-Banking Financial Companies (NBFCs) for regulatory purposes.

The Master Direction – Know Your Customer (KYC) Direction, 2016 issued by the Reserve Bank of India has consolidated directions on Know Your Customer (KYC), Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) and is applicable to all Regulated Entities of RBI. As HFCs are also entities to be regulated by the RBI after the said transfer of regulation, RBI, on May 19, 2020, decided to extend the said Master Direction to all HFCs and repealed the instructions/guidelines/regulations issued by the National Housing Bank from time to time in this regard. Accordingly, the Master Direction –Know Your Customer (KYC) Direction, 2016 issued by the Reserve Bank of India also applies to …………………………………………………………………. (the Company)

Paragraph 4 of the said Directions requires every HFC to have a Know Your Customer (KYC) policy duly approved by its Board or by any committee of the Board to which power has been delegated. Paragraph 5 mandates the inclusion of the following four key elements in the KYC Policy,namely:-

Accordingly, in compliance with the aforesaid directions issued by the RBI, and in supersession of all its existing policies, executive orders, and instructions issued from time to time in this regard, the following KYCPolicy has been approved by the Board of Directors of the Company.

The KYC Policy framed hereunder is to be read and followed in conjunction with Know Your Customer (KYC) Direction, 2016, as amended from time to time, issued by the RBI ( copy annexed as Annexure I) or any other applicable law in force and in the event of any inconsistency, the latter shall prevail.

The Company shall further ensure compliance with the provisions of the Prevention of Money-Laundering Act, 2002, and the Prevention of Money-Laundering (Maintenance of Records) Rules, 2005, as amended from time to time, including operational instructions issued in pursuance of such amendment(s).

In view of the foregoing, Key objectives of the KYC and AML Policy are as under:

a) Name of the Policy

This Policy shall be known as “Know Your Customer (KYC) Policy of ………………………”.

b) Applicability:

This Policy shall be applicable to all categories of products and services offered by the Company and shall be followed by every branch, office, official, employee, service provider, attorney, or any other delegated authority acting or conducting business on behalf of the Company.

c) Effective Date :

The Policy shall come into force with immediate effect.

A. Unless the context otherwise requires, the terms herein shall bear the meanings assigned to them below:

i. “Aadhaar number” shall have the meaning assigned to it in clause (a) of section 2 of the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 (18 of 2016);

ii. “Authentication”, in the context of Aadhaar authentication, means the process as defined under sub-section (c) of section 2 of the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016.

iii. ” Beneficial Owner (BO)” means:

a) Where the customer is a company, the beneficial owner is the natural person(s), who, whether acting alone or together or through one or more juridical persons, having controlling ownership interest or who exercise control through other means.

Explanation – For the purpose of this sub-clause-

(i) “Controlling ownership interest” means ownership of / entitlement to more than 25 percent of the shares or capital or profits of the company.

(ii) “Control” shall include the right to appoint a majority of the directors or to control the management or policy decisions, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements.

b) Where the customer is a partnership firm, the beneficial owner is the natural person(s), who, whether acting alone or together or through one or more juridical person, having ownership of / entitlement to more than 15 percent of capital or profits of the partnership.

c) Where the customer is an unincorporated association or body of individuals, the beneficial owner is the natural person(s), who, whether acting alone or together or through one or more juridical person, having ownership of/ entitlement to more than 15 percent of the property or capital or profits of the unincorporated association or body of individuals.

Explanation: Term ‘body of individuals’ includes societies. Where no natural person is identified under (a), (b), or (c) above, the beneficial owner is the relevant natural person who holds the position of senior managing official.

d) Where the customer is a trust, the identification of beneficial owner(s) shall include identification of the author of the trust, the trustee, the beneficiaries with 15% or more interest in the trust and any other natural person exercising ultimate effective control over the trust through a chain of control or ownership.

iv. “Certified Copy” of Officially Valid Document (OVD)– means obtaining and comparing the copy of the proof of possession of Aadhaar Number where offline verification cannot be carried out or OVD so produced by the customer with the original and recording the same on the copy by the authorized officer under his unique number ( such as PF No. or employee number etc.) . The authorized officer will also attest to the duly signed photograph of the customer.

Provided that in case of Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs), as defined in Foreign Exchange Management (Deposit) Regulations, 2016 {FEMA 5(R)}, alternatively, the original certified copy, certified by anyone of the following, may be obtained:

v. “Central KYC Records Registry” (CKYCR) means an entity defined under Rule 2(1) of the Prevention of Money-Laundering (Maintenance of Records) Rules, 2005, to receive, store, safeguard and retrieve the KYC records in digital form of a customer.

vi.“Customer” means a person who is engaged in a financial transaction or activity with the Company and includes a person on whose behalf the person who is engaged in the transaction or activity, is acting.

vii.“Customer Due Diligence” (CDD) means identifying and verifying the customer and the beneficial owner.

viii. “Customer identification” means undertaking the process of CDD.

ix. “Designated Director” means a person so designated by the Board to ensure overall compliance with the obligations imposed under chapter IV of the PML Act and the Rules thereunder and shall include the Managing Director or a whole-time Director (as defined under the Companies Act, 2013) duly authorized by the Board.

x. “Digital KYC” means the capturing live photo of the customer and officially valid document or the proof of possession of Aadhaar, where offline verification cannot be carried out, along with the latitude and longitude of the location where such live photo is being taken by an authorized officer of the Company as per the provisions contained in the Act.

xi. “Digital Signature” shall have the same meaning as assigned to it in clause (p) of subsection (1) of section (2) of the Information Technology Act, 2000

xii. “Equivalent e-document” means an electronic equivalent of a document, issued by the issuing authority of such document with its valid digital signature including documents issued to the digital locker account of the customer as per rule 9 of the Information Technology (Preservation and Retention of Information by Intermediaries Providing Digital Locker Facilities) Rules, 2016.

xiii. “Know Your Client (KYC) Identifier” means the unique number or code assigned to a customer by the Central KYC Records Registry.

xiv.“KYC Templates” means templates prepared to facilitate collating and reporting the KYC data to the CKYCR, for individual and legal entities.

xv. “Non-face to face customers’ means customers who opens accounts without visiting the branch/office of the Company or meeting the officials of the Company.

xvi. “Officially Valid Document” (OVD) means the passport, the driving license, proof of possession of Aadhaar number, the Voter’s Identity Card issued by the Election Commission of India, job card issued by NREGA duly signed by an officer of the State Government, and the letter issued by the National Population Register containing details of name and address

Provided that,

a) Where the customer submits his proof of possession of Aadhaar number as an OVD, he may submit it in such form as are issued by the Unique Identification Authority of India.

b) Where the OVD furnished by the customer does not have updated address, the following documents or the equivalent e-documents thereof shall be deemed to be OVDs for the limited purpose of proof of address:-

c) The customer shall submit OVD with a current address within a period of three months of submitting the documents specified at b) above;

d) Where the OVD presented by a foreign national does not contain the details of address, in such case, the documents issued by the Government departments of foreign jurisdictions and letter issued by the Foreign Embassy or Mission in India shall be accepted as proof of address.

Explanation: For the purpose of this clause, a document shall be deemed to be an OVD even if there is a change in the name subsequent to its issuance provided it is supported by a marriage certificate issued by the State Government or Gazette notification, indicating such a change of name.

xvii “Offline verification” shall have the same meaning as assigned to it in clause (pa) of section 2 of the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 (18 of 2016)

xviii“On-going Due Diligence” means regular monitoring of transactions in accounts to ensure that they are consistent with the customers’ profile and source of funds.

xix. “Person” includes: a) an individual, b) a Hindu undivided family, c) a company, d) a firm, e) an association of persons or a body of individuals, whether incorporated or not, f) every artificial juridical person, not falling within any one of the above persons (a to e), and g) any agency, office or branch owned or controlled by any of the above persons (a to f).

xx. “Periodic Updation” means steps taken to ensure that documents, data, or information collected under the CDD process are kept up-to-date and relent by undertaking reviews of existing records at periodicity prescribed by the Reserve Bank.

xxi. “Politically Exposed Persons” (PEPs) are individuals who are or have been entrusted with prominent public functions in a foreign country, e.g.,Heads of State/Governments, senior politicians, senior government/judicial/military officers, senior executives of state-owned corporations, important political party officials, etc.

xxii. “Principal Officer” means an officer nominated by the Company for ensuring compliance, monitoring transactions, sharing and reporting information as required under the law/ regulations, and responsible for communicating and furnishing information to FIU-IND under PML Rules.

xxiii.“Suspicious transaction” means a “transaction”, including an attempted transaction, whether or not made in cash, which, to a person acting in good faith:

(i) gives rise to a reasonable ground of suspicion that it may involve proceeds of an offence specified in the Schedule to the PML Act, regardless of the value involved; or

(ii) appears to be made in circumstances of unusual or unjustified complexity; or

(iii) appears to not have an economic rationale or bonafide purpose; or

(iv) gives rise to a reasonable ground of suspicion that it may involve financing of the activities relating to terrorism.

Explanation: Transaction involving financing of the activities relating to terrorism includes transaction involving funds suspected to be linked or related to, or to be used for terrorism, terrorist acts or by a terrorist, terrorist organization, or those who finance or are attempting to finance terrorism.

xxiv. “Transaction” means a purchase, sale, loan, pledge, gift, transfer, delivery or the arrangement thereof and includes:

a) opening of an account;

b) deposit, withdrawal, exchange or transfer of funds in whatever currency, whether in cash or by cheque, payment order or other instruments or by electronic or other non-physical means;

c) entering into any fiduciary relationship;

d) any payment made or received, in whole or in part, for any contractual or other legal obligation; or

e) establishing or creating a legal person or legal arrangement.

xxv. “UCIC” means Unique Customer Identification Code, i.e., unique customer-ID allotted to individual customers while entering into new relationships as well as to the existing customers. All the accounts of an individual customer will be opened under his / her UCIC.

xxvi. “Video based Customer Identification Process (V-CIP)” means a method of customer identification by an official of the Company by undertaking seamless, secure, real-time, consent based audio-visual interaction with the customer to obtain identification information including the documents required for CDD purpose and to ascertain the veracity of the information furnished by the customer. Such a process shall be treated as a face-to-face process for the purpose of this KYC Policy. (Wherever applicable)

xxvii. “Walk in Customer” means a person who does not have an account-based relationship with the Company, but undertakes transactions with the Company.

B. All other expressions unless defined herein shall have the same meaning as having been assigned to them, under the RBI’s Master Circular – Know Your Customer (KYC) Direction, 2016, the Reserve Bank of India Act, 1935, the Banking Regulation Act, 1949, the Prevention of Money Laundering Act, 2002, the Prevention of Money Laundering (Maintenance of Records) Rules, 2005, the Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016 and regulations made thereunder, any statutory modification or re-enactment thereto or as used in commercial parlance, as the case may be.

3.1 The Company shall adhere to the following customer acceptance policy:

In such exceptional circumstances before rejection of service to customers on the issue of his identity, necessary approval from a level senior to the officer normally taking such decision should be obtained.

Customer identification means identifying the customer and verifying his/her identity by using reliable, independent source documents, data, or information. The Company shall, therefore, obtain sufficient information necessary to establish, to its satisfaction, the identity of each new customer /beneficiary of the relationship/account, whether regular or occasional, and the purpose of the intended nature or relationship.

However, the Company shall not seek an introduction while opening accounts.

a) Commencement of an account-based relationship with the customer.

b) In case of any doubt about the authenticity or adequacy of the customer identification data,it has obtained.

c) While entering into the transaction:

i. of selling third party products as an agent;

ii. of selling the Company’s own products and services;

iii. for a non-account based customer/ walk-in customer;

if thevalue of a single transaction or series of transactions that appear to be connected is more than rupees fifty thousand.

d) When it has reason to believe that a customer is intentionally structuring a transaction into a series of transactions below the threshold of Rs. 50,000/-.

The Company for the purpose of verifying the identity of customers, while entering into account based relationship, may rely on customer due diligence done by a third party, subject to the following conditions:

a) Such third party has been duly appointed in writing by the Company for that purpose;

b) Records or the information of the customer due diligence carried out by the third party is obtained within two days from the third party or the Central KYC Records Registry;

c) Copies of identification data and other relevant documentation relating to the customer due diligence requirements shall be made available without delay to the Company as and when desired.

d) The third party is regulated, supervised, or monitored for and has measures in place for compliance with customer due diligence and record-keeping requirements in line with the requirements and obligations under the PML Act.

e) The ultimate responsibility for customer due diligence and undertaking enhanced due diligence measures, as applicable, will be with the Company.

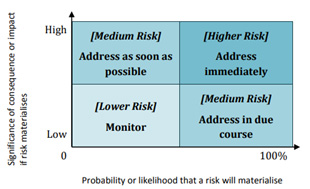

“Risk Management” in the present context refers to money laundering, terrorist funding risk, credit, and financial risks associated with a particular customer from the Company’s perspective. This risk is based on risk perceptions associated with customer profile and level of risk associated with the product & channels used by the customer.

5.1 For Risk Management, the Company shall have a risk based approach.

a) The Company shall categorize its customers based on the risk perceived by the Company.

b) The Company shall categorize its customers into low, medium, and high-risk category, based on the assessment, profiling, and money laundering risk.

c) The parameters such as customer’s identity, social/ financial status, nature of the business activity, and information about the clients’ business and their location, etc. shall be considered for the risk assessment.

d) The ability to confirm identity documents through online or other services offered by issuing authorities shall also be factored in determining the risk category of the customer.

e) It is to be mentioned here that various other information collected about different categories of customers relating to the perceived risk, is non-intrusive and in accordance with this Policy.

5.2 However, the Company may use FATF Public Statement, the reports andguidance notes issued by Government, RBI, or other authorities on KYC/AML procedures in risk assessment.

5.3 The following indicative parameters are to be used to determine the profile and risk category of customers:

a) Customer Constitution: Individual, Proprietorship, Partnership, Private Ltd., etc.

b) Business Segment: Retail, Corporate etc

c) Country of residence/ Nationality: Whether India or any overseas location/ Indian or foreign national.

d) Economic Profile: Asset size, Business Diversity, Risk bearing capacity, etc.

e) Account Vintage/ seasoning: Less than six months old etc.

h) Presence in regulatory negative/ PEP/ Defaulters/ Fraudster lists.

i) Suspicious Transaction Report (STR) filed for the customer.

j) AML alerts

k) Other parameters: like a source of funds, occupation,nature of the business, mode of operation, credit rating, etc. can also be used in addition of the above parameters.

The Company shall adopt all or majority of these parameters based on the availability of data.

5.3.1 An indicative list of customers’ behavior and risks based classification as also the risk based transactions to be monitored by the Company will be prepared and made available by the Designated Director /Principal Officer.

5.4. For effective risk management, the Company shall ensure that it has an effective KYC program. The overall KYC program will cover proper management oversight, systems and controls, segregation of duties, training, and other related matters. Responsibilities will be explicitly allocated within the Company to ensure that the Company’s policies and procedures are implemented effectively.

5.5.1. The money laundering and terrorist financing risk for the Company are likely to be low due to the following reasons:

5.5.2. However, in accordance with the regulatory requirements, the Company will carry out money laundering and terrorist financing exercise periodically to identify, assess and take effective measures to mitigate money laundering and terrorist financing risk to which the Company may be exposed to. Such internal risk assessment shall be commensurate to its size, geographical presence, the complexity of activities/structure, etc.

5.5.3. The exercise undertaken by the Company shall be properly documented, and the assessment process will consider various relevant risk factors and will take cognizance of overall sector-specific vulnerabilities, if any, that the regulator/supervisor may share. Accordingly, it will frame its mitigation plan also. It should involve the relevant functions and have the following stages:

5.5.4. The Company shall conduct the money laundering and terrorist financing Risk Assessment at least once in a year or at such other intervals as may be decided by the Board.

The outcome of the ML and TF Risk Assessment will be put up to the Audit Committee or such other Committee as may be decided by the Board.

Ongoing monitoring is an essential element of effective KYC procedures. The Company can effectively control and reduce its risk only if it has an understanding of the normal and reasonable activity of the customer so that it can identify transactions that fall outside the regular pattern. The Company will put in place a process to identify and review complex and unusual transactions/ patterns which have no apparent economic or visible lawful purpose, or transactions that involve large amounts of cash or are inconsistent with the normal and expected activity of the customer.

.1CDD procedure in case of individuals

For undertaking CDD in individual cases, the Company shall obtain the following from an individual while establishing an account based relationship or while dealing with the individual who is a beneficial owner, authorised signatory or the power of attorney holder related to any legal entity:

The Company may also carry-out KYC verification under Digital KYC Process defined below (at sub-para 7.1.3).

7.1.2. Video based Customer Identification Process (“V-CIP”)

The Company may undertake live V-CIP, to be carried out by an official of the Company, for the establishment of an account-based relationship with an individual customer, after obtaining his informed consent.

The Company, if implements V-CIP, will adhere to the following requirements:

7.1.3. Digital KYC Process

In case Digital KYC Process is adopted by the Company, it will ensure compliance with the following requirements:

7.1.4. Simplified procedure for opening accounts of Individuals

In case a person who desires to open an account is not able to produce any of the OVDs, the Company may at its discretion open accounts subject to the following conditions:

7.1.5. For establishing an account based relationship, the authorized official to ascertain as to whether the customer already has a Customer ID with the Company. In case the customer has an existing Customer ID, the new account shall be opened with the same existing Customer ID.

7.1.6. KYC verification, once done by one branch or office of the Company, shall be valid for transfer of the account to any other branch or office, provided full KYC verification has already been done for the concerned account, and the same is not due for periodic updation.

7.2 CDD Measures for Sole Proprietary firms

7.2.1. For opening an account in the name of a sole proprietary firm, CDD of the individual (proprietor) shall be carried out.

7.2.2. In addition to the above, any two of the following documents or the equivalent e-document thereof as a proof of business/ activity in the name of the proprietary firm shall also be obtained:

(i) Registration certificate

(ii) Certificate/ License issued by the municipal authorities under Shop and Establishment Act.

(iii) Sales and income tax returns.

(iv) CST/ VAT/ GST certificate (provisional/ final).

(v) Certificate/ registration document issued by Sales Tax/ Service Tax/ Professional Tax authorities.

(vi) IEC (Importer Exporter Code) issued to the proprietary concern by the office of DGFT/ License/ certificate of practice issued in the name of the proprietary concern by any professional body incorporated under a statute.

(vii) Complete Income Tax Return (not just the acknowledgement) in the name of the sole proprietor where the firm’s income is reflected, duly authenticated/ acknowledged by the Income Tax authorities.

(viii)Utility bills such as electricity, water, and landline telephone bills.

7.2.3. In cases where the Company is satisfied that it is not possible to furnish two such documents, the Company may, at its discretion, accept only one of those documents as proof of business activity.

Provided the Company undertakes contact point verification and collect such other information and clarification as would be required to establish the existence of such firm, and shall confirm and satisfy itself that the business activity has been verified from the address of the proprietary concern.

7.3. CDD Measures for Legal Entities

7.3.1. Partnership Firm: For opening an account of a partnership firm, the certified copies of each of the following documents or the equivalent e-documents thereof shall be obtained:

(a) Registration certificate

(b) Partnership deed

(c) Permanent Account Number of the partnership firm

(d) Documents, as specified in paragraph7, relating to beneficial owner, managers, officers or employees, as the case may be, holding an attorney to transact on its behalf

7.3.2. Company: For opening an account of a company, certified copies of each of the following documents or the equivalent e-documents thereof shall be obtained:

(a) Certificate of incorporation

(b) Memorandum and Articles of Association

(c) Permanent Account Number of the company

(d) A resolution from the Board of Directors and power of attorney granted to its managers, officers or employees to transact on its behalf

(e) Documents, as specified in paragraph7 above, relating to the beneficial owner, the managers, officers or employees, as the case may be, holding an attorney to transact on the company’s behalf

7.3.4. Trust: For opening an account of a trust, certified copies of each of the following documents or the equivalent e-documents thereof shall be obtained:

(a) Registration certificate

(b) Trust deed

(c) Permanent Account Number or Form No. 60 of the trust

(d) Documents, as specified in paragraph 7, relating to beneficial owner, managers, officers or employees, as the case may be, holding an attorney to transact on its behalf

7.3.4. Unincorporated Bodies or associations: For opening an account of an unincorporated association or a body of individuals, certified copies of each of the following documents or the equivalent e-documents thereof shall be obtained:

(a) Resolution of the managing body of such association or body of individuals;

(b) Permanent Account Number or Form No. 60 of the unincorporated association or a body of individuals;

(c) Power of attorney granted to transact on its behalf;

(d) Documents, as specified in paragraph 7 relating to the beneficial owner, the managers, officers or employees, as the case may be, holding an attorney to transact on its behalf; and

(e) Such additional information as may be required by the Company, to collectively establish the legal existence of such an association or body of individuals

Explanation:

i. Unregistered partnership firms/ trusts shall be included under the term ‘Unincorporated associations’.

ii. Term body of individuals’ includes ‘societies’

7.3.5. For opening an account of Hindu Undivided Family, certified copies of each of the following documents shall be obtained:

(a) Identification information, as mentioned under paragraph 7 in respect of the Karta and Major Coparceners,

(b) Declaration of HUF and its Karta,

(c) Recent Passport photographs duly self-attested by major co-parceners along with their names and addresses.

(d) The Permanent Account Number or the equivalent e-document thereof or Form No. 60 as defined in Income-tax Rules, 1962.

7.3.6. Juridical Person: For opening accounts of juridical persons not specifically covered in the earlier part, such as societies, universities and local bodies like village panchayats, certified copies of the following documents or the equivalent e-documents thereof shall be obtained:

(a) Document showing name of the person authorized to act on behalf of the entity;

(b) Documents, as specified in paragraph 7 above, of the person holding an attorney to transact on its behalf; and

(c) Such other documents as may be specified by the Company in writing to establish the legal existence of such an entity/ juridical person.

7.4 Identification of Beneficial Owner

For opening an account of an entity who is not a natural, the beneficial owner(s) shall be identified and all reasonable steps in terms of sub-rule (3) of Rule 9 of the Prevention of Money-Laundering (Maintenance of Records) Rules, 2005 to be undertaken to verify his/ her identity keeping in view the following:

(a) Where the customer or the owner of the controlling interest is a company listed on a stock exchange or is a subsidiary of such a company, it is not necessary to identify and verify the identity of any shareholder or beneficial owner of such companies.

(b) In cases of trust/ nominee or fiduciary accounts where the customer is acting on behalf of another person as trustee/ nominee or any other intermediary is determined. In such cases, satisfactory evidence of the identity of the intermediaries and of the persons on whose behalf they are acting, as also details of the nature of the trust or other arrangements in place shall be obtained.

Ongoing monitoring is an essential element of effective KYC procedures. The Company can effectively control and reduce its risk only if it has an understanding of the normal and reasonable activity of the customer so that it can identify transactions that fall outside the regular pattern. The Company will put in place a process to identify and review complex and unusual transactions/ patterns which have no apparent economic or visible lawful purpose, or transactions that involve large amounts of cash or are inconsistent with the normal and expected activity of the customer.

The Extent of monitoring shall be aligned with the risk category of the customer, and high risk customer will be subjected to more intensified monitoring.

The Company will conduct periodic updation of KYC documents at least once in every 2 years for high risk customers, once in every 8 years for medium risk customers and once in every 10 years for low risk customers

in any of the following manner:

10.1 Accounts of non-face-to-face customers: The Company will ensure the first payment is done through any of the KYC Compliant account through banking channels.

10.2 Accounts of Politically Exposed Persons (PEPs):If the Company decides to establish a business relationship with PEPs, it will ensure the following:

10.2.2The above will also be applicable to accounts where a PEP is a beneficial owner.

CDD of all the members of SHG shall not be required while opening the account of SHG.

(b) CDD all the office bearers of SHG shall suffice.

(c) No separate CDD under paragraph 7of the members or office bearers is necessary at the time of extending credit to SHGs.

13.1In accordance with the requirements under the PMLA, the Company will furnish the following reports, as and when required, to the Director, Financial Intelligence Unit-India (FIU-IND):

Additionally, the Company will submit ‘Statement showing the details of Counterfeit Banknotes detected’ to the NHB within 7 days from the last day of the respective quarter. Even in the case of ‘Nil’ instance also, the statement is to be submitted to the NHB

13.2 The Company will maintain confidentiality in investigating suspicious activities and while reporting CTR/ CCR/ STR to the FIU-IND/ higher authorities and ensure that there is no tipping off to the customer at any level.

13.3The Company shall also endeavor to install robust software, throwing alerts when the transactions are inconsistent with risk categorization and updated profile of the customers shall be put in to use as a part of effective identification and reporting of suspicious transactions.

14.1 Officials of the Company shall maintain secrecy regarding the customer information which arises out of the contractual relationship between the Company and customer and requests for data/information from Government and other agencies, the Company shall first satisfy themselves that the information being sought is not of such a nature as will violate the provisions of the laws relating to secrecy in mutual dealing except in following circumstances:

i. Where disclosure is under compulsion of law,

ii. Where there is a duty to the public to disclose,

iii. the interest of the Company requires disclosure, and

iv. Where the disclosure is made with the express or implied consent of the customer.

14.2 The Company shall maintain the confidentiality of information as provided in Section 45NB of the RBI Act, 1934.

14.3 The Company shall not use the information collected from the customer for the purpose of cross selling or for any other purpose without the express permission of the customer.

The Company will capture the KYC information/ details as per KYC templates and share the same with the CKYCR in the manner as prescribed in the Prevention of Money Laundering (Maintenance of Records) Rules, 2005.

The Company, if applicable, will adhere to the provisions of Income Tax Rules 114F, 114G, and 114H. If the Company becomes a Reporting Financial Institution as defined in Income Tax Rule 114F, it will take requisite steps for complying with the reporting requirements in this regard.

The Company will ensure compliance with Section 51A of UAPA Act, 1987 by screening the prospective and existing account holders for UN Sanction List or any other list as per UAPA Act, 1987. In the event, any account holder resembles the name of as per the list, it will be reported to FIU-IND and Ministry of Home Affairs. Further, other requirements including the freezing of assets, shall be followed by the Company.

The Company acting as agents while selling third party products as per regulations in force from time to time shall comply with the following:

(a) the identity and address of the walk-in customer shall be verified for transactions above rupees fifty thousand as required under paragraph 4 of this Policy.

(b) transaction details of the sale of third party products and related records shall be maintained as prescribed.

(c) Anti-money Laundering (AML) software capable of capturing, generating and analyzing alerts for the purpose of filing CTR / STR in respect of transactions relating to third party products with customers including walk-in customers shall be available.

(d) transactions involving rupees fifty thousand and above shall be undertaken only by:

i. debit to customers’ account or against cheques; and

ii. obtaining and verifying the PAN given by the account based as well as walk-in customers.

Permanent account number (PAN) of customers shall be obtained and verified while undertaking transactions as per the provisions of Income Tax Rule 114B as amended from time to time. Form 60 shall be obtained from persons who do not have PAN.

Seeking of certain KYC information from customers can sometimes lead to queries from the customer as to the motive and purpose of collecting such information. In this regard, the Company will take appropriate steps to educate customers on the objectives of the KYC measures.

a. Designated Director

1. The Board shall designate either the Managing Director or any whole-time director as the Designated Director to ensure overall compliance with the obligations imposed under this Policy in the matter of KYC compliance or imposed under Chapter IV of the PML Act and the Rules.

2. The name, designation, and address of the designated director shall be communicated to the FIU-IND.

3. The Board shall not nominate the Principal Officer as the Designated Director.

4. The Designated Director, in consultation with the Principal Officer, shall be responsible for setting up the policies for implementation of the KYC program and shall issue subsidiary policies or documents for operationalizing the policy.

5. The Designated Director shall allocate responsibilities of officials/departments for ensuring compliance with the KYC Policy.

b. Principal Officer

1. The Board shall nominate an officer, not below the rank of …….. as Principal Officer of the company.

2. The name, designation, and address of the Principal Officer shall be communicated to the FIU-IND.

3. The Board shall not nominate the Designated Director as the Principal Offcier.

4. The Principal Officer shall assist the Designated Director for setting up various policies for implementation of the KYC Program.

5. The Principal Officer shall be responsible for ensuring compliance, monitoring transactions, and sharing and reporting information as required under the law/regulations.

c. Senior Management

1. Senior Management for the purpose of KYC compliance shall mean Designated Director, Principal Officer, and head of each department in the Company.

2. Senior Management shall assist the Principal Officer/Designated Director in the effective implementation of the KYC Program and submit compliance status report to them.

d. Internal Audit

1. Quarterly audit notes and compliance status shall be submitted to the Audit Committee.

2. The audit findings and compliance thereof will be put up before the Audit Committee of the Board till the closure of findings.

1. The Policy will be reviewed annually by the Board.

2. Any amendment to the policy considered necessary for effective implementation of the KYC Program any time during the year shall be carried out by the Designated Director and shall be placed for ratification at the next meeting of the Board.

The Company shall endeavour to use the latest available technology for determining and ensuring compliance with KYC norms.

The Company shall not outsource decision-making functions of determining compliance with KYC norms.

If you have any questions or queries about the training programs please connect with us. Our team will be glad to help you with your needs.

Copyright © Pioneer Housing Finance Academy 2024. All rights reserved.

Design & Developed By: Softstudioz IT Services